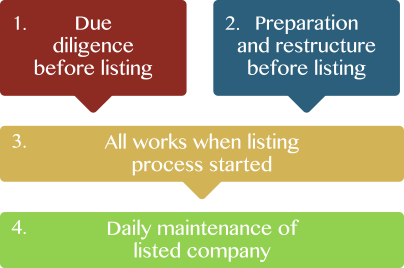

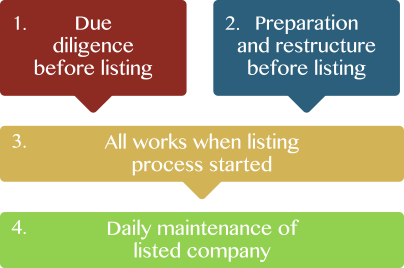

Planning and execution of IPOs

Listing Process

Investment banks in the market generally provide formulaic sponsor service only, and fail to fully understand the clients and their listing barrier, as a result, most of the listing cases were suspended or terminated during the period of drafting the prospectus.

As a comprehensive financial advisor, Euto will provide a board insight to our clients by advising the listing barrier in advance.

Your Best Listing Advisor

Euto is assembled by a group of talents with different professional backgrounds, including law, accounting and corporate finance. The team has wide range of knowledge and experience. We are familiar with various listing process in Hong Kong.

|